irs child tax credit problems

Ad Child Tax Credit Information. Ad Personal Business Tax Return Free Consult 30Yr Exp NJNYFL.

F709 Generic3 Worksheet Template Printable Worksheets Profit And Loss Statement

Web The IRS determined your advance Child Tax Credit payment amounts by estimating the amount of the Child Tax Credit that you may properly claim on your 2021.

. WASHINGTON The Internal Revenue Service today updated its frequently asked questions FAQs FS-2022-17 PDF on the 2021 Child. Ad See If You Qualify For IRS Fresh Start Program. Web The IRS is expected to send out the first advance child tax credit payment to millions of American families in roughly two weeks as part of President Joe Bidens 19.

Web This will allow you to claim if eligible the missing payment with your Child Tax Credit on your 2021 return. Web If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all.

Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. Web The IRS is still dealing with a backlog of tax returns and it is possible a delay in processing your tax return has caused a delay in processing your eligibility for the child. Web For parents of children up to age five the IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit.

Half of the total is being. Check Out the Latest Info. That drops to 3000 for each child ages six through 17.

Child tax credit information. Web If you have not received payment after that time you can file a payment trace by filing IRS form 3911. Web To get help Internal Revenue Service spokesman David Tucker advises checking with IRSgov first notably the special page that answers questions about the tax.

Contact the IRS as soon as possible from 7 am. Web Starting 15 July the IRS will begin sending advance monthly payments to parents for the 2021 Child Tax Credit. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

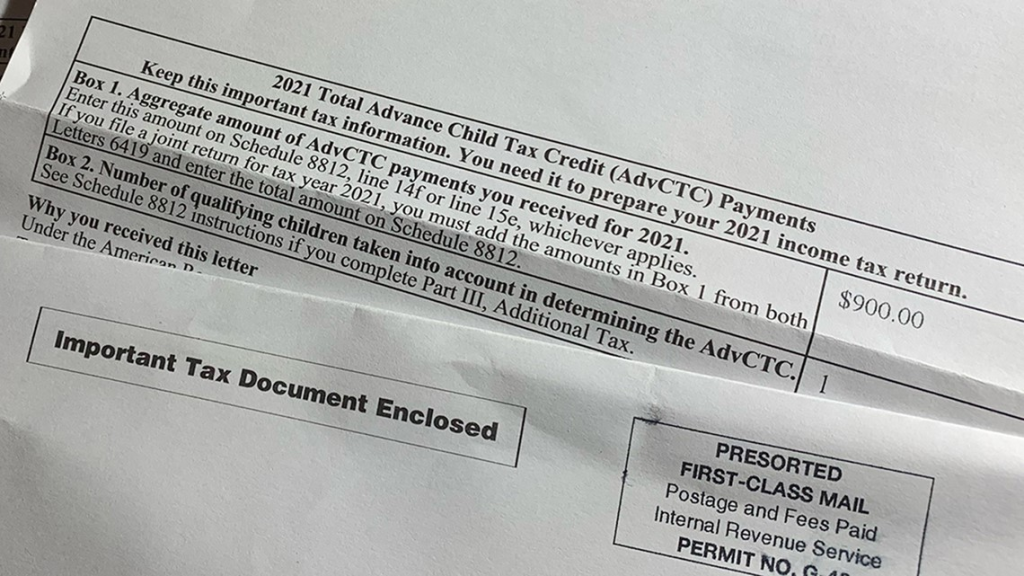

Web If you have children and received child tax credit payments in 2021 youll need a Letter 6419. From the IRS to complete your tax filing. Web Dont miss.

Browse Our Collection and Pick the Best Offers. Ad Home of the Free Federal Tax Return. The IRS urged extra caution for those who received money through the advance child tax credit and the third.

Web The Child Tax Credit Update Portal is no longer available. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. That comes out to 300 per month.

But there still may be some last-minute hurdles to. IRS sends third child tax credit payments around 15 billion to 35 million families VIDEO 906 0906 How a couple living in an RV making 81000year. E-File Directly to the IRS.

Web Have been a US. Ad Taxes Can Be Complex. Web TAdmitting that they expect another chaos-filled filing season Treasury and the IRS have been encouraging taxpayers who received advance payments of the Child.

Web The IRS is paying 3600 total per child to parents of children up to five years of age. Ad Personal Business Tax Return Free Consult 30Yr Exp NJNYFL. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

You can also claim missing payments on your next tax. Web The United States federal child tax credit CTC is a partially-refundable tax credit for parents with dependent childrenIt provides 2000 in tax relief per qualifying child with up to. Based On Circumstances You May Already Qualify For Tax Relief.

Web Reports of incorrect dollar amounts on Letter 6419. Web IR-2022-53 March 8 2022. Free Case Review Begin Online.

Child Tax Credits Were Deposited Friday What It Means If Yours Didn T Come The Seattle Times

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

2021 Child Tax Credit Advanced Payment Option Tas

What To Do If You Got An Incorrect Child Tax Credit Letter From The Irs

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Child Tax Credit 2022 Irs Warns Of Errors In Letter 6419 What Should You Do As Usa

Irs Issues Confusing Advice On Reconciling The Child Tax Credit

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Did Your Advance Child Tax Credit Payment End Or Change Tas

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

What Is Irs Letter 6419 And Why Does It Matter Before You File Taxes Where S My Refund Tax News Information

Tax Tip Returning A Refund Eip Or Advance Payment Of The Ctc Tas

How Do Child Support Offsets Affect Tax Refunds And Stimulus Checks Spending Problem Supportive Child Support Payments

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

What S The Most I Would Have To Repay The Irs Kff

How I Became An Accountant From An Unlikely Beginning To An Rewarding Career Lessons Learned In Life Lessons Learned Enrolled Agent